ricegum.ru

Community

Do Americans Need Visa For Dubai

The official UAE website says that US passport holders can get free Visa on Arrival however the process of getting Visa on arrival is not mentioned anywhere. Almost all nationals of Africa and Asia will need to apply for a visa before travel from the nearest UAE embassy or mission. We have more information on that. 30‑day visit eligibility. If you are a passport holder of the below country or territory, no advance visa arrangements are required to visit the UAE. You will only need to ensure that your passport is valid for six months before your departure. Once you arrive at the airport, you can apply for a visitor visa. Visa Requirements for US Citizens (regular passport only) The visa is available upon arrival only, valid for 30 days from the date of entry. Creating a safe haven. When investors get their residence visas, they do not need to stay in the country long to maintain their status. It is only enough to. Visa Requirements for Non-US Citizens (regular passport only). If you are a citizen of one of the following countries, visa is available upon arrival only. Do I need a visa to visit the UAE? If you're eligible for a visa on arrival, you do not need to apply for a visa before you travel to the UAE. If you're not. Depending on your passport, you may need to arrange a visa before you fly to your destination. Check whether you need one here. Explore Dubai on a longer. The official UAE website says that US passport holders can get free Visa on Arrival however the process of getting Visa on arrival is not mentioned anywhere. Almost all nationals of Africa and Asia will need to apply for a visa before travel from the nearest UAE embassy or mission. We have more information on that. 30‑day visit eligibility. If you are a passport holder of the below country or territory, no advance visa arrangements are required to visit the UAE. You will only need to ensure that your passport is valid for six months before your departure. Once you arrive at the airport, you can apply for a visitor visa. Visa Requirements for US Citizens (regular passport only) The visa is available upon arrival only, valid for 30 days from the date of entry. Creating a safe haven. When investors get their residence visas, they do not need to stay in the country long to maintain their status. It is only enough to. Visa Requirements for Non-US Citizens (regular passport only). If you are a citizen of one of the following countries, visa is available upon arrival only. Do I need a visa to visit the UAE? If you're eligible for a visa on arrival, you do not need to apply for a visa before you travel to the UAE. If you're not. Depending on your passport, you may need to arrange a visa before you fly to your destination. Check whether you need one here. Explore Dubai on a longer.

Even if you wanted to leave the airport and do some sight seeing/museums, US passport holders do not need a visa for tourism for a stay of up to. Passport holders of the below countries do not require any pre-arranged visas. Your passport will be stamped with a free-of-charge, day visit visa on arrival. Answer: If you will not leave the transit lounge at the airport you are not required to have transit visa. Otherwise, you have to make visa application to the. India –Indian Nationals who have visas for, or permanent resident status in, US, UK, Canada and Schengen countries do not require a visa to enter The Bahamas. American citizens who have regular passports do not need to have a visa to visit the UAE. However, please make sure you fulfil following criteria's: Original. 30‑day visit eligibility. If you are a passport holder of the below country or territory, no advance visa arrangements are required to visit the UAE. Has a valid passport with a minimum of three months validity. • Has a multiple entry visa with six (6) months of remaining validity from ONE of the following. Citizens of certain other countries must obtain a visa from one of the UAE diplomatic missions. Alternatively, they may obtain an online visa through Smart. Travellers cannot enter the UAE when travelling with a temporary passport or an emergency travel document. Visas. Tourist visa: not required. Business visa. US Citizens Need A Visa For UAE. To go to and enter the United Arab Emirates, Americans need a single-entry tourist visa. Below are the details for this visa. Visas & Passports for Travel to the UAE. US citizens with a US passport that is valid for more than six months do not need to obtain a visa prior to entry. US citizens who intend to visit the UAE for 30 days or less do not need to apply for a visa prior to arrival in the country they can get a. Even if you wanted to leave the airport and do some sight seeing/museums, US passport holders do not need a visa for tourism for a stay of up to. Emirati citizens do not need a visa to enter other Gulf Cooperation Council (GCC) countries and also have the right to work and reside in those countries. If you're going to have a stopover in the UAE on your way to a third destination, you may need to apply for a UAE Transit Visa, depending on your. For US passport holders traveling on our Dubai packages, we will obtain your free visa for the UAE upon arrival. Yes. If you are a citizen of one of the countries listed below and you meet the required criteria, you can obtain a visa on arrival. Nationals of more than 30 countries are eligible for a free visa on arrival in Dubai, and do not need to apply in advance. USA, Australia, New Zealand, Canada. Yes US citizens need a visa to work in Dubai. However they get a visit visa on arrival at Dubai airport and they can stay for two months on. I Need To See News & Events · A U.S. Visa · To Study in the U.S. · U.S. Citizen Message for U.S. Citizens: U.S. Consulate Dubai Seeking Citizen Liaison.

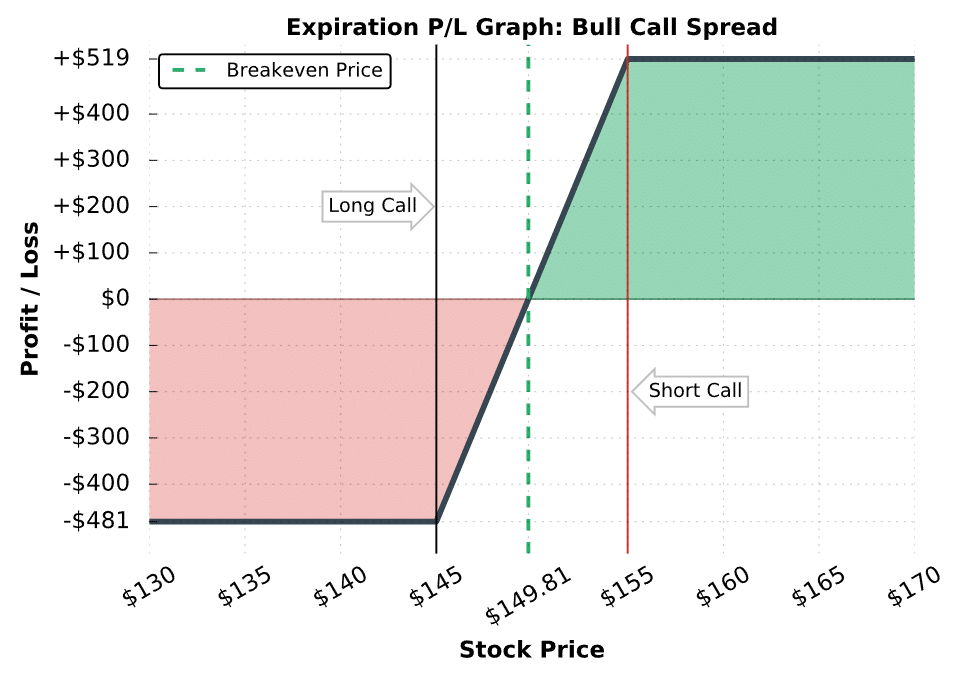

Call Credit Spread Strategy

Pick the same strike/delta for your short call. For your long call, how much money are you willing to accept as a max loss and how much are you. The difference results in a net short premium position, or a credit trade. A short call spread, and a short put spread are credit spreads, because the short. A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. Learn more. Net debit = maximum loss; Net credit = maximum gain ; Call spreads = add net premium to the low strike; Put spreads = subtract net premium from the high strike. Explore the credit spread strategy, including bull put spreads and bear call spreads. Understand the calculation formula and learn more about this trading. By writing calls and buying calls to create a credit spread, you will usually make a profit if the underlying security falls in price or stays fairly stable. It involves selling a call option, and collecting an upfront option premium, while simultaneously purchasing a second call option with the same expiration date. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. Both calls have the same underlying stock. A call credit spread is a type of option strategy used to capitalize on neutral or bearish price movement of the underlying stock. Call credit spreads are an. Pick the same strike/delta for your short call. For your long call, how much money are you willing to accept as a max loss and how much are you. The difference results in a net short premium position, or a credit trade. A short call spread, and a short put spread are credit spreads, because the short. A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. Learn more. Net debit = maximum loss; Net credit = maximum gain ; Call spreads = add net premium to the low strike; Put spreads = subtract net premium from the high strike. Explore the credit spread strategy, including bull put spreads and bear call spreads. Understand the calculation formula and learn more about this trading. By writing calls and buying calls to create a credit spread, you will usually make a profit if the underlying security falls in price or stays fairly stable. It involves selling a call option, and collecting an upfront option premium, while simultaneously purchasing a second call option with the same expiration date. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. Both calls have the same underlying stock. A call credit spread is a type of option strategy used to capitalize on neutral or bearish price movement of the underlying stock. Call credit spreads are an.

Call credit spreads are a type of options trading strategy that involves selling a call option with a lower strike price and buying a call. This bear call spreads strategy is to realize a profit by making cash that is a net credit formed by the difference in a SOLD CALL price and a BOUGHT CALL. A call credit spread is a type of vertical spread. It's a bearish, two-legged options strategy that involves selling a call option and buying another with a. Call credit spreads can be an effective way to profit when an option trader expects a stock to stay below a certain area. Many times this area is potential. A bear call spread is a limited-risk, limited-reward strategy, consisting of one short call option and one long call option. This strategy generally profits if. Now we'll move on to credit spreads. Is this the best vertical spread options strategy? A Call Credit Spread is a trade where you simultaneously sell a call. To sell a vertical call option spread, you sell a call option for a credit and simultaneously purchase a long call option of the same expiration date. A short call spread, or bear call spread, is an advanced vertical spread strategy with an obligation to sell and a right to buy at two different strike. You make money on a put credit spread by collecting a net premium from selling a put with a higher strike price (thus a higher premium) and buying a put with a. A bearish vertical spread strategy which has limited risk and reward. It combines a short and a long call which caps the upside, but also the downside. A bull call spread is the strategy of choice when the forecast is for a gradual price rise to the strike price of the short call. Impact of stock price change. A short call credit spread is a bearish, defined risk options trading strategy, and consists of a long and short call option contract in the same expiration. A bear call spread is a bearish options strategy constructed by selling a call The maximum gain for a bear call spread is the net credit received when. A bull put credit spread is entered when the seller believes the price of the underlying asset will be above the short put option's strike price on or before. This strategy is used when an investor expects the price of the underlying asset to decrease or remain stable. The sold call option with the lower strike price. A bear call spread involves selling a call option with a lower strike price and simultaneously buying a call option with a higher strike price. This structure. Allow PowerOptions to share their knowledge on everything about two advanced option trading strategies - bear call spreads and option credit spreads. Since the investor is receiving more for the lower strike call than they are paying for the higher strike, the net cost of combining the two strike prices is a. A short call credit spread is a bearish, defined risk options trading strategy, and consists of a long and short call option contract in the same expiration. – Strategy Generalization · Spread = Difference between the strikes. – = · Net Credit = Premium Received – Premium Paid. – 38 =

Virtual Pups

PumpkinPups Dog Training · Private Training · Group Classes for Puppies & Adult Dogs · Scentwork Classes · Online Workshops · Canine Good Citizen Classes & Testing. Virtual Tribute Wall · Virtual Sponsor Wall · Volunteer · Veterinary Partnerships PUPPY - sEAVER. NASHVILLE SC - CASH. Amazin' Mets Puppy - Shea. WBAL TV. The official twitter channel of VirtualPups - The world's greatest multiplayer dog training game! Dog training for the real world. In person services in Omaha, NE. Virtual services worldwide. For pet owners: virtual and in person group and private training. Furry Paws is a free virtual dog game where you raise, train, show, and breed virtual dogs - Choose your breedings carefully to produce the best possible pups. Five Pups also reserves the right to contact an emergency veterinarian if virtual meeting. We take the safety of those in our care very seriously. pup or make the bitch name a link? nAlso, pups returning from auction and dogs we got stud requests for etc, basically everything we get a message about. If you have multiple pups, the app lets you create individual profiles for each one. Dive into the PupPod online game and discover the fun and excitement your. Services · Veterinary Services · Dog Boarding · Dog Daycare · Dog Training · Dog Grooming · Virtual Care · About Pups@Play. PumpkinPups Dog Training · Private Training · Group Classes for Puppies & Adult Dogs · Scentwork Classes · Online Workshops · Canine Good Citizen Classes & Testing. Virtual Tribute Wall · Virtual Sponsor Wall · Volunteer · Veterinary Partnerships PUPPY - sEAVER. NASHVILLE SC - CASH. Amazin' Mets Puppy - Shea. WBAL TV. The official twitter channel of VirtualPups - The world's greatest multiplayer dog training game! Dog training for the real world. In person services in Omaha, NE. Virtual services worldwide. For pet owners: virtual and in person group and private training. Furry Paws is a free virtual dog game where you raise, train, show, and breed virtual dogs - Choose your breedings carefully to produce the best possible pups. Five Pups also reserves the right to contact an emergency veterinarian if virtual meeting. We take the safety of those in our care very seriously. pup or make the bitch name a link? nAlso, pups returning from auction and dogs we got stud requests for etc, basically everything we get a message about. If you have multiple pups, the app lets you create individual profiles for each one. Dive into the PupPod online game and discover the fun and excitement your. Services · Veterinary Services · Dog Boarding · Dog Daycare · Dog Training · Dog Grooming · Virtual Care · About Pups@Play.

WHAT'S INCLUDED PUPS & PASTRIES REGISTRATION: IN-PERSON and VIRTUAL 5K, Mile, and Fun Mile race options. Dog-friendly. Pups in the Park is a unique opportunity to bring your dog to a Nationals game. You and your dog will both get to enjoy the game with other dogs and dog lovers. Frequently Asked Questions About Roblox Adopt Me Perfect Pups Blue Dog Mystery Figure w/ Virtual Item Code in My Website. ricegum.ru is the best online. Submit virtual home check photos or video; If approved, arrange to meet the dog; If it's a match, complete adoption contract and return signed to Pups Without. Pupspace is the home for pup play enthusiasts. We welcome members of all genders, orientations and backgrounds. If you enjoy the pup headspace, you belong here. Come support JR's Pups-N-Stuff by eating at Panda Express! This virtual fundraiser is nationwide, so you can participate anywhere!! All you need to do is. WSC's Virtual Holiday Silent Auction! Wolf Pup Experience with Infant Pups Wolf Pup Experience with Infant Pups. Meet WSC's youngest ambassadors. We offer a variety of virtual and in person services to fit your unique needs · In Person Training (Omaha, NE) · Virtual Services · Dog Daycare Consulting · Shop. By Appointment Only. Mon - Sat: 10am - 2pm Walk-In Nail Trim. Home Pic ricegum.ru VIRTUAL. TOUR. Play. Your dog will have fun playing 'Pit Ball', tug, fetch. Pause with Pups: A Virtual Therapy Dog Event Dogs with text "Pause with Pups: A Virtual Therapy Dog Event. Monday September. For many people, dogs (and other. Pups & Pastries Virtual Races Pups and Pastries by Fit & Able Productions, Inc. returns for – with life-saving benefits for our animals! If you'd like to. This Wii game, titled "Barbie: Groom and Glam Pups," allows players to simulate caring for and styling virtual pets. It was released in and has a. A charity that provides financial aid for education and training for rescue dogs. Private School Pups. DONATESHOP TO SAVEAugust 27 Virtual Rubber Duck Dive. Virtual Learning. Florida Keys ProgramsToggle submenu. Schools & Groups · Kids Shark Pups & Grown-Ups. Today's Research for Tomorrow's Oceans. MEGA-lodon. Montclair Pups at Play: Vet care, boarding, daycare, training & grooming! See Montclair Virtual Care · Livingston Virtual Care · Wellness Care · Montclair. PUPS are: Preparing for kindergarten; Understanding our needs; Playing Virtual Education · Wellness. Rolla Public Schools. A Forum Drive | Rolla, MO. Buy Tickets Online. Skip to main content. Vendor List · Show Specials · Sponsors · Show Info. I'm looking for. I'm looking for. Just Four Pups. Just Four Pups. Furry Paws is a free virtual dog game where you raise, train, show, and breed virtual dogs - Choose your breedings carefully to produce the best possible pups. SwiftPaws CHASE! Mental & Physical Enrichment For Pups. Play video. View Pups give us four paws up, and humans love us too! See what customers have.

Citadel Hedge Fund News

Citadel LLC is an American multinational hedge fund and financial services company. Founded in by Ken Griffin, it has more than $63 billion in assets. Citadel Global Fixed Income Fund is a Hedge Fund in Florida with $ mm assets under management, with a minimum investment of $ mm. Stay up-to-date with breaking news and top stories on Citadel LLC. In-depth analysis, industry insights and expert opinion. CoStar News. March 18, | AM. Rapidly expanding US hedge fund Citadel is in talks to take a ,square-foot-plus headquarters at British Land's. Explore our unique perspective on the markets, company news, civic leadership and public policy. Read the latest news and insights from the firm. Instead, they now refer to themselves as "private investment funds," and their influence is being felt across a number of financial markets. Although most funds. News about Citadel Investment Group, including commentary and archival Elliott Management, the $55 billion hedge fund, has taken a big stake in the. Citadel Investment Group - Ken Griffin - News, Interviews, and Investor Letters. Citadel skirts hedge fund industry upheaval. Ken Griffin's Staying current is easy with Crain's news delivered straight to your inbox, free of charge. Citadel LLC is an American multinational hedge fund and financial services company. Founded in by Ken Griffin, it has more than $63 billion in assets. Citadel Global Fixed Income Fund is a Hedge Fund in Florida with $ mm assets under management, with a minimum investment of $ mm. Stay up-to-date with breaking news and top stories on Citadel LLC. In-depth analysis, industry insights and expert opinion. CoStar News. March 18, | AM. Rapidly expanding US hedge fund Citadel is in talks to take a ,square-foot-plus headquarters at British Land's. Explore our unique perspective on the markets, company news, civic leadership and public policy. Read the latest news and insights from the firm. Instead, they now refer to themselves as "private investment funds," and their influence is being felt across a number of financial markets. Although most funds. News about Citadel Investment Group, including commentary and archival Elliott Management, the $55 billion hedge fund, has taken a big stake in the. Citadel Investment Group - Ken Griffin - News, Interviews, and Investor Letters. Citadel skirts hedge fund industry upheaval. Ken Griffin's Staying current is easy with Crain's news delivered straight to your inbox, free of charge.

Get the latest news, data and filings for Citadel Wellington, with free alerts. Includes transcripts, social sentiment, and more. This is a record, marking the most successful first month ever for a hedge fund startup. Do you have a news tip for Investopedia reporters? Please email us at. Citadel Solutions starting Operational Alpha, the first fully integrated hedge fund trading platform for users of Bloomberg's AIM institutional order. Hedge Fund Journal Lists Three Citadel Women Among 50 Leading Women in Hedge Funds · Read More · Ken Griffin Moving Citadel From Chicago to Miami · Read More. Investment Group has managed and grown the wealth of successful individuals and institutional investors since Our discipline and consistency have led. Stay up-to-date with breaking news and top stories on Citadel LLC. In-depth analysis, industry insights and expert opinion. Ken Griffin's hedge fund Citadel to move to new London development ricegum.ru Citadel is one of the world's leading alternative investment firms,pursuing long-term returns for preeminent public and private institutions. Citadel Global Fixed Income Fund is a Hedge Fund in Florida with $ mm assets under management, with a minimum investment of $ mm. Bloomberg News. Bei Hu. Published Jul 16, • 2 minute read Citadel's hedge fund business has about employees in Asia. While most of them are. News about Citadel Investment Group, including commentary and archival Elliott Management, the $55 billion hedge fund, has taken a big stake in the. Citadel. Americas · Billionaire Ken Griffin buys 'Apex' stegosaurus Hedge-fund billionaire outbid cryptocurrency group for US constitution · Virus. Ken Griffin founded and runs Citadel, a Miami-based hedge fund firm that manages $59 billion in assets. · Griffin founded Citadel in but first began trading. Ken Griffin's hedge fund Citadel to move to new London development ricegum.ru News · Events · People · Top 30 Lists · Jobs · Forum · Podcast · Login. Hedge Funds. Ken Griffin's U.S. hedge fund Citadel made $16 billion in profit after fees. Citadel Readies For Construction Of Miami Headquarters: Why The Hedge Fund Billionaire Is Taking His Talents To Florida (CORRECTED). 5 months ago. Billionaire. NEWS: Ken Griffin's Citadel hedge fund has tripled its position in Jim Dolan's Sphere Entertainment to %. AMC DOJ Targets CITADEL Executives! Let's help em Apes! r/amcstock Investigation of the corrupt banks that fund hedge funds? Yes. Subscribe to The Unusual Whales News! Citadel was among the hedge funds that got Morgan Stanley's, $MS, block-trading leaks. 2/8/ Citadel was among the. Bloomberg News. Bei Hu. Published Jul 16, • 2 minute read Citadel's hedge fund business has about employees in Asia. While most of them are.

Is A Home Warranty Required

A home warranty can provide peace of mind and financial protection for homeowners. It can cover the cost of repairs and replacements for. Do You Need A Home Warranty Contract? 1. What benefits and/or repairs are covered by the home warranty contract? Most home warranty contracts do not cover. For example, an AHS® home warranty covers up to 23 of your home's major systems and appliances. Unlike home insurance, home warranties are not mandatory and are. Home warranty contracts often require you to use the company's private arbitration process to settle disputes. That means you give up your right to take the. Keep records of all of the maintenance you do on your home. • Make sure you understand and follow the home warranty contract requirements, which may include. Even though warranties and insurance help you protect your property, repairs and maintenance will be necessary, even in a new home. Make sure you can cover. And while homeowners insurance is required by most lenders, a home warranty is not. Progressive Home Warranty by Cinch offers three types of home warranty. This brochure highlights the requirements of the New. Home Warranty and Builders' Registration Act to help you understand your responsibilities as a builder. A service contract must be in compliance with the requirements of N.Y. Ins. Law §§ (McKinney ), which pertain to service contracts, as well as. A home warranty can provide peace of mind and financial protection for homeowners. It can cover the cost of repairs and replacements for. Do You Need A Home Warranty Contract? 1. What benefits and/or repairs are covered by the home warranty contract? Most home warranty contracts do not cover. For example, an AHS® home warranty covers up to 23 of your home's major systems and appliances. Unlike home insurance, home warranties are not mandatory and are. Home warranty contracts often require you to use the company's private arbitration process to settle disputes. That means you give up your right to take the. Keep records of all of the maintenance you do on your home. • Make sure you understand and follow the home warranty contract requirements, which may include. Even though warranties and insurance help you protect your property, repairs and maintenance will be necessary, even in a new home. Make sure you can cover. And while homeowners insurance is required by most lenders, a home warranty is not. Progressive Home Warranty by Cinch offers three types of home warranty. This brochure highlights the requirements of the New. Home Warranty and Builders' Registration Act to help you understand your responsibilities as a builder. A service contract must be in compliance with the requirements of N.Y. Ins. Law §§ (McKinney ), which pertain to service contracts, as well as.

Every home warranty contract must contain a cancellation provision per Section , Florida Statutes. Within 10 days: A home warranty agreement may be. Home warranties cover repairs and replacements for systems and appliances that fail due to normal wear and tear. Homeowners insurance covers homes and property. Major mechanical systems that are covered include plumbing, electrical, heating and air. Many states require that all home builders and contractors warranty. Homeowners can protect their investment in many ways. In addition to homeowner's insurance, the County by law, requires new home construction to have warranty. home insurance and home warranties. While not required, a home warranty complements homeowners insurance by covering damage that home insurance policies don't. The New Home Warranty and Builders' Registration Act has two elements, the builder's repair requirement and the warranty policy. It provides ten year coverage. Is the home warranty cost included in the closing fees? In certain states the home warranty fees are not required as part of the closing costs. When this is. What Does a Home Warranty Not Cover? · Cosmetic damage · Damage from pests · Misuse · Types of damage covered by your homeowners insurance, including secondary. Home warranties can have limited coverage, and might exclude kitchen appliances, water heaters, plumbing, furnaces, and other major appliances. Often consumers. What you pay will depend on the home warranty provider you choose and your coverage plan, but a standard home warranty contract costs an average of $30 – $ Home warranties aren't mandatory, but they can provide homeowners with peace of mind and help cover out-of-pocket costs for unexpected repairs or replacement of. A · A · Home warranties are designed to protect your home's appliances and systems from breakdowns caused by normal wear and tear. · No, not even if you need to. The standard home warranty is a one-year service contract that protects a resale home buyer against the cost of unexpected repairs or replacement of major. Home warranties are absolutely ideal for those purchasing an older house. When buying a home, unless it's completely brand-new, you're likely to have a. Is the home warranty cost included in the closing fees? In certain states the home warranty fees are not required as part of the closing costs. When this is. Why Do You Need a Home Warranty? With homeownership comes the responsibility of home repairs. If your water heater fails or your air conditioning breaks, you. But owning a home may also require ongoing and expensive repairs, from repairing a broken appliance to replacing a damaged roof. Depending on what needs to be. If you haven't yet finished paying off your house, you are likely required to have homeowners insurance. If you own your home outright, you can decide whether. If you're moving into a newly built home, a home warranty isn't usually necessary. The appliances are all new, so there's less of chance that they'll break. In.

Best Trading Platform For Roth Ira

Best Roth IRA for Mobile Trading TD Ameritrade's Roth IRAs are free to open, and you can choose from several commission-free ETFs, fixed-income investments. Roth IRA Tax-free retirement growth · What is a Roth IRA? · Benefits of a Roth IRA · Pick the Fidelity Roth IRA that fits you best · Other ways to invest with our. If you'd like to invest on your own in a Roth IRA, Fidelity offers the best all-around broker experience. Vanguard is best for low-cost mutual funds. A brokerage account is generally less restrictive than an IRA or retirement account; there is no contribution limit and you can withdraw your money at any time. A Roth IRA is an individual retirement account where you pay taxes on money going into your account, and then all future withdrawals are tax-free. Compare other accounts to the nonretirement Vanguard Brokerage Account and see which may fit your investing goals and needs best. IRA to the Roth IRA. If you'. Charles Schwab offers brokerage and retirement accounts, online trading, plus products outside of investing like checking and savings accounts, home loans. IRA and a Roth is the income limit with IRAs. In , if Self-managed portfolios allow you to buy, sell, and trade through an online trading platform. Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA Roth IRA · E*Trade Roth. Best Roth IRA for Mobile Trading TD Ameritrade's Roth IRAs are free to open, and you can choose from several commission-free ETFs, fixed-income investments. Roth IRA Tax-free retirement growth · What is a Roth IRA? · Benefits of a Roth IRA · Pick the Fidelity Roth IRA that fits you best · Other ways to invest with our. If you'd like to invest on your own in a Roth IRA, Fidelity offers the best all-around broker experience. Vanguard is best for low-cost mutual funds. A brokerage account is generally less restrictive than an IRA or retirement account; there is no contribution limit and you can withdraw your money at any time. A Roth IRA is an individual retirement account where you pay taxes on money going into your account, and then all future withdrawals are tax-free. Compare other accounts to the nonretirement Vanguard Brokerage Account and see which may fit your investing goals and needs best. IRA to the Roth IRA. If you'. Charles Schwab offers brokerage and retirement accounts, online trading, plus products outside of investing like checking and savings accounts, home loans. IRA and a Roth is the income limit with IRAs. In , if Self-managed portfolios allow you to buy, sell, and trade through an online trading platform. Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA Roth IRA · E*Trade Roth.

Roth IRA accounts only allow investors to contribute to their funds after paying their taxes; therefore, the amount accumulated in a Roth IRA account can be. At Schwab, there are multiple ways to start investing. You can choose to handle trades on your own, or work with an advisor to help you plan, or even take. Buy, sell, and trade stocks online with a brokerage account from Wells Fargo Advisors WellsTrade Plan for retirement with traditional, Roth, and SEP IRAs. What makes it great: Interactive Brokers is powerful enough for Wall Street investors managing institutional investment accounts. As an individual trader using. Charles Schwab does it all: great education and training for newer investors, high-caliber tools for active traders, responsive customer service and no trading. Interactive Brokers offers cash or margin Individual Retirement Accounts (IRAs). IRA margin accounts allow trading so the account can be fully invested as well. The trading platform is easy to use, there is no account minimum and no commissions to pay on trades. Pros. Commission-free trades; Thousands of investment. Overall, the combined capabilities of Charles Schwab and TD Ameritrade make this platform a strong contender for best IRA account brokerage. E-Trade — Best IRA. Trade online with J.P. Morgan Wealth Management. Commission-free trades. Get Investing account (General Investment, Traditional IRA, or Roth IRA). To. Merrill Edge offers a wide range of investment products and advice, including brokerage and retirement accounts, online trading, and financial research. TD Ameritrade, Inc. has been acquired by Charles Schwab, and all accounts have been moved. At Schwab, you get access to thinkorswim® trading platforms and. Charles Schwab, Fidelity, Vanguard, TD Ameritrade, and E*Trade from Morgan Stanley each offer Roth IRAs and their application processes are fairly similar. Roth. Fidelity was named NerdWallet's winner for Best Broker for Beginning Investors, Best Online Broker for IRA Investors, Best App for Investing, Best Online. Best Roth IRA Providers of ; GREAT FOR: ROBUST INVESTMENT OPTIONS AND EDUCATIONAL RESOURCES, ALL WITH LOW OR NO FEES. Best Self-Directed: Fidelity. Open a taxable Brokerage account or Traditional, Roth or Rollover Brokerage IRA in minutes. You can also choose from a number of account registrations. E*TRADE - the best IRA brokerage in Low trading fees (free stock and ETF trading). User-friendly mobile trading platform. Great research tools. Pays. Interactive Brokers, X · X · Offers cash and margin IRA accounts ; Ally Invest, X · Offers a range of banking and loan products in addition to retirement accounts. trading level that best aligns with your financial goals and risk tolerance. You can roll over your employer-based retirement account to a traditional or Roth. An E*TRADE Roth IRA lets you invest your way. Our Roth IRA lets you withdraw Pricing applies to online secondary market trades. Includes Agency. Most Popular · Brokerage account · Core Portfolios · Premium Savings Account · Traditional IRA · Roth IRA · Rollover IRA.

Refinance Higher Interest Rate

This process of substituting an existing mortgage with a new one is called mortgage refinancing, and it is typically done to access lower mortgage interest. 1. Get a lower interest rate and monthly payment. As a borrower, you could potentially save thousands of dollars over the term of your loan when you lock in a. Refinancing may provide an opportunity to get a better interest rate or make a good mortgage even better. Either way, you'll increase your short- and long-term. Freedom Mortgage may be able to offer you a refinance rate that is lower—or higher—than the rate you see advertised by other lenders. Ask us today what. Perhaps you purchased your home Are you still stuck with high interest rates on your mortgage? If so, it might be time to consider refinancing. If interest. Meanwhile, the average APR on a year fixed refinance mortgage is %. This same time last week, the year fixed-rate mortgage APR was %. The average. Fundamentally, it doesn't make a lot of sense to refinance debts to a higher interest rate, as that will cost more in the long run (you are. When it comes to mortgage rates, even a small change makes a difference. On a $, year fixed rate mortgage, an interest rate of % lower means you'll. A cash-out refinance will replace your existing mortgage with a new, larger mortgage. You'll receive the difference between the new loan balance and your old. This process of substituting an existing mortgage with a new one is called mortgage refinancing, and it is typically done to access lower mortgage interest. 1. Get a lower interest rate and monthly payment. As a borrower, you could potentially save thousands of dollars over the term of your loan when you lock in a. Refinancing may provide an opportunity to get a better interest rate or make a good mortgage even better. Either way, you'll increase your short- and long-term. Freedom Mortgage may be able to offer you a refinance rate that is lower—or higher—than the rate you see advertised by other lenders. Ask us today what. Perhaps you purchased your home Are you still stuck with high interest rates on your mortgage? If so, it might be time to consider refinancing. If interest. Meanwhile, the average APR on a year fixed refinance mortgage is %. This same time last week, the year fixed-rate mortgage APR was %. The average. Fundamentally, it doesn't make a lot of sense to refinance debts to a higher interest rate, as that will cost more in the long run (you are. When it comes to mortgage rates, even a small change makes a difference. On a $, year fixed rate mortgage, an interest rate of % lower means you'll. A cash-out refinance will replace your existing mortgage with a new, larger mortgage. You'll receive the difference between the new loan balance and your old.

Refinance rates · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. How Much Does Refinancing a Mortgage Cost? Lenders charge fees to refinance just as they would for a purchase mortgage. Homeowners pay $5, on average to. To enjoy the benefits of debt consolidation, you should not carry new credit card or high interest rate debt. By refinancing your existing mortgage, your total. Refinancing your mortgage to a conventional loan might allow you more options for mortgage terms and loan types. By refinancing, you could choose to shorten. Refinancing to access equity at a higher rate could work short-term, but you may end up paying a lot more in interest over the full loan. Might. High-interest credit card debt can be a significant financial burden. Paying off this debt with today's soaring interest rates can require substantial. Credit score: Borrowers with higher credit scores generally qualify for lower interest rates. Loan-to-Value (LTV) Ratio: The LTV ratio compares the amount of. Nowadays mortgage rates are closer to %. If the Fed stops raising rates then I'd anticipate mortgage rates to also stop going up. That's good news for. The drop in interest rates beginning in and an increase in housing prices have provided households with the opportunity to reduce monthly mortgage payments. Additionally, the current national average year fixed refinance rate decreased 12 basis points from % to %. The current national average 5-year ARM. The rise in interest rates is reducing, and likely to further reduce, the number of people who refinance their mortgages. See here: Mortgage. Rates continue to soften due to incoming economic data that is more sedate. But despite the improving mortgage rate environment, prospective buyers remain on. Refinance rates are the interest rates lenders offer when you're replacing your current mortgage with a new loan, often with different terms or conditions. As. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. One of the primary benefits of refinancing is the ability to reduce your interest rate. A lower interest rate may mean lower mortgage payments each month. Plus. Raise your credit score. · Budget some extra cash to pay points. · Shop and haggle with refinance lenders. · Compare APRs and interest rates. · Avoid second. This cost is larger on refinances than on purchases because lock-jumping is more common among refinancers. Borrowers who are refinancing usually are flexible on. Today's competitive refinance rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · When the mortgage is refinanced, it is for $, plus any closing costs rolled into the loan. Not only does their loan-to-value ratio go up, but their debt-. Lenders cover the cost of the refinancing by charging a higher interest rate or rolling the fees into the total loan amount. Increasing your loan amount bumps.

Business Loans Like Kabbage

Fundbox and Kabbage both offer exactly one funding product: a business line of credit. That means that they both give you a credit limit and let you borrow as. As a pioneer in technology that supports entrepreneurs, Kabbage prioritized launching a mobile app to establish a new, even more convenient lending experience. Kabbage · OnDeck · EZBOB · CAN Capital · Fundbox · Funding Circle · BlueVine · Affirm · Credit Karma. Publicly Traded. Founded USA. Credit Karma is. Looking for a small business loan to get the working capital you need? Learn why Kabbage is the fastest and simplest way to get funding for your business. business and consumer loans space against newer startup web-based players like Kabbage, OnDeck, Lending Club, etc.? All related (37). GET A CLEARER PICTURE OF YOUR CASH FLOW Designed for small business owners like you, the free American Express Business Blueprint™ app offers a single. Not sure if you should get your business line of credit from Bluevine or from Kabbage? We compare their rates, requirements, and more to help you pick. For businesses that need flexible, on-demand access to money, Kabbage is a great choice. This lender structures loans as credit lines, so you won't pay interest. Best Small Business Loans For Startups: LendingTree vs Lending Club vs Kabbage vs OnDeck vs Funding Circle & More ; Online vs Traditional Loans|online-vs-. Fundbox and Kabbage both offer exactly one funding product: a business line of credit. That means that they both give you a credit limit and let you borrow as. As a pioneer in technology that supports entrepreneurs, Kabbage prioritized launching a mobile app to establish a new, even more convenient lending experience. Kabbage · OnDeck · EZBOB · CAN Capital · Fundbox · Funding Circle · BlueVine · Affirm · Credit Karma. Publicly Traded. Founded USA. Credit Karma is. Looking for a small business loan to get the working capital you need? Learn why Kabbage is the fastest and simplest way to get funding for your business. business and consumer loans space against newer startup web-based players like Kabbage, OnDeck, Lending Club, etc.? All related (37). GET A CLEARER PICTURE OF YOUR CASH FLOW Designed for small business owners like you, the free American Express Business Blueprint™ app offers a single. Not sure if you should get your business line of credit from Bluevine or from Kabbage? We compare their rates, requirements, and more to help you pick. For businesses that need flexible, on-demand access to money, Kabbage is a great choice. This lender structures loans as credit lines, so you won't pay interest. Best Small Business Loans For Startups: LendingTree vs Lending Club vs Kabbage vs OnDeck vs Funding Circle & More ; Online vs Traditional Loans|online-vs-.

Looking for a small business loan to get the working capital you need? Learn why Kabbage is the fastest and simplest way to get funding for your business. At the time, when Kabbage was founded, banks typically used information such as credit ratings,. financial statements and income tax returns to evaluate loan. Traditional financial institutions, such as banks and credit unions, offer Small Business Administration (SBA) loans. These loans are often more substantial and. For a small business loan of $10, with a strong credit score, you might consider checking online lenders like Kabbage, OnDeck, or BlueVine. Best for Business Tools: Kabbage · Best Short-Term Line of Credit: Fundbox · Best for Bad Credit: SnapCap · Best for Startups: Accion · Best for Low Rates. Helping simplify cash flow management for small businesses | Kabbage Loans, Small Business Financing, and Small Business Line Of Credit. Locations. business loans in the online lending industry of $ million. Accredited investors can buy pre-IPO stock in companies like Kabbage through EquityZen funds. Kabbage is an online business lender owned by American Express (Amex). The services include a business line of credit and some financial management tools. business loans in the online lending industry of $ million. Accredited investors can buy pre-IPO stock in companies like Kabbage through EquityZen funds. Term Loans up to $K and Lines of Credit up to $K. Get funds as soon as the same day. The minimum credit score requirement for Kabbage loans is which puts them in line with many competitors like OnDeck, and Fundbox. How to Compare a Fundbox, Kabbage, OnDeck, and Bluevine Line of Credit. You have several options when it comes to applying for a business line of credit. This. Founded in , Kabbage offers financing to small businesses through Celtic Bank. Loans are unsecured, though the bank can place a lien on your business assets. Are Kabbage Loans Too Good to be True? · Kabbage facilitates short term loans to businesses that don't qualify for traditional financing due to limited operating. Top small business loans of SBA loans, term loans, and lines of credit. Find financing for business equipment, expenses, more. As fast as same-day. Collateral: Some types of business loans, such as equipment, real estate Kabbage Payments, LLC is a registered Payment Service Provider/Payment. Dive in as we review the complete list of Alternative Lending Platforms for Entrepreneurs. Learn how business loans work from companies like kabbage and. Top small business loans of SBA loans, term loans, and lines of credit. Find financing for business equipment, expenses, more. As fast as same-day. The Top Alternatives to Kabbage Includes Credible, PROSPER, Lending Club, Iwoca and 11 other products in Small Business Loans. Kabbage · Applying is free. · No Credit Check. · No prepayment fees/penalties. · Automated system that you can access 24/7. · Every month you pay back on loan plus a.

Factors That Affect Homeowners Insurance Premiums

:max_bytes(150000):strip_icc()/calculating-premium.asp_sketch_revised-5eb88ace64ae40cfa39d93ba9a23f19c.png)

In the event of damage or a loss, it will cost more to repair or rebuild your home, which causes your insurance premium to rise. If you do any major overhaul to. QTO Construction · Location · Home's Age and Condition · Replacement Cost · Home's Construction Materials · Security and Safety Features · Deductible. Insurance companies consider many factors when setting homeowner rates. Understanding how this affects your premiums — as well as shopping around — can save. A:Answer Home insurance costs vary by carrier, but there are some common factors that insurers are likely to consider when setting rates, including the type. The size of your family also impacts your homeowners insurance premium. Larger families may be perceived as having a higher risk of accidents or incidents. We have listed the factors that an insurance company looks at when providing you with a quote for your homeowners insurance. So What are some key factors that can affect home insurance premiums? · 1. Continuous property insurance · 2. Replacement cost of your home · 3. Does having a. What Factors Affect Your Home Insurance Cost? · 1. Location · 2. Age And Condition Of The Home · 3. Coverage Amount · 4. Deductible · 5. Home Security · 6. Claims. 1. The location of your home. Your state and even your ZIP code can influence the amount you pay in home insurance premiums. In the event of damage or a loss, it will cost more to repair or rebuild your home, which causes your insurance premium to rise. If you do any major overhaul to. QTO Construction · Location · Home's Age and Condition · Replacement Cost · Home's Construction Materials · Security and Safety Features · Deductible. Insurance companies consider many factors when setting homeowner rates. Understanding how this affects your premiums — as well as shopping around — can save. A:Answer Home insurance costs vary by carrier, but there are some common factors that insurers are likely to consider when setting rates, including the type. The size of your family also impacts your homeowners insurance premium. Larger families may be perceived as having a higher risk of accidents or incidents. We have listed the factors that an insurance company looks at when providing you with a quote for your homeowners insurance. So What are some key factors that can affect home insurance premiums? · 1. Continuous property insurance · 2. Replacement cost of your home · 3. Does having a. What Factors Affect Your Home Insurance Cost? · 1. Location · 2. Age And Condition Of The Home · 3. Coverage Amount · 4. Deductible · 5. Home Security · 6. Claims. 1. The location of your home. Your state and even your ZIP code can influence the amount you pay in home insurance premiums.

Your state, city and even your neighborhood can affect the cost of your home insurance premium. However, location is just one of many factors that account for. The cost of a homeowners insurance premium depends on your provider, policy, location, and credit history, among other factors. You can save money on your. Learn how factors like replacement costs, construction types, and garage styles impact your rates. Explore the significance of location, including proximity to. Construction materials may influence your rate for home insurance, as well as the type of siding and number of stories. Your roof's age and materials may also. Your state, city and even your neighborhood can affect the cost of your home insurance premium. However, location is just one of many factors that account for. Hurricane season, hailstorms, wildfires and other weather catastrophes affect construction costs as supply dwindles and demand increases. Your home's rebuild. Affects on Cost Like auto insurance, the cost of homeowner's coverage depends largely on where you live. Crime rates vary from community to community, as does. Insurers will look to see if a homeowner has paid her bills on time and check credit scores. A lower number could result in higher premiums. 3. Location. Shop around · Raise your deductible · Don't confuse what you paid for your house with rebuilding costs · Buy your home and auto policies from the same insurer. Your personal information, your credit history, claims history, and marital status can all contribute to your premium costs. How the Location of a Home Can Affect Homeowners Insurance Rates · 1. Home Insurance Costs Vary by State. The city and state in which we live can play a direct. Personal factors, such as your credit score, claims history, and the age and size of your household, can also impact your homeowner's insurance premiums, and. Age, size, and condition of home. Common sense tells us that it will cost more to insure a larger or more luxurious home, or a home near the water. Additional. Factors Affecting Your Premium · Replacement cost of home · Type of construction · Distance to fire department · Proximity to the coast · Age of your home · How you. Factors That Can Affect Your Homeowners Insurance Premiums · Credit History. Most insurance companies will look at your credit score as one of many ways of. Age, size, and condition of home. Common sense tells us that it will cost more to insure a larger or more luxurious home, or a home near the water. Additional. Your background: Many different underlying factors can play a role in your rate—some you may not even think about. Your age, marital status, the family. >Homeowners Insurance>Knowledge. How to Lower Your Home Insurance Premium: Factors That Affect Your Homeowners Insurance Rates. Jackie Cohen. Written byJackie. Features That May Decrease Insurance Rates. Alarm system (burglar and/or fire); Gated entrance; Wind mitigation. *Not all homeowners insurance companies offer.

How Much Should You Spend On Groceries

According to the U.S. Bureau of Labor Statistics, Americans devote between 11% and 15% of their budget to food each year. If you're sitting at the 15% mark. In January , the average monthly food costs for home-prepared meals for a family of six (with the same ages as Debbie's family members) ranged from. Calculate Overall Costs · Adjusted food costs for each person in household. · 1-person — add 20 percent · 2-person —add 10 percent · 3-person — add 5 percent · Americans spend an average of $5, a year, or roughly $ a month, on groceries, according to consumer expenditure data released by the U.S. Bureau of Labor. According to the USDA guidelines, you might spend $ a month on a thrifty plan, $1, on a low-cost plan, $1, on a moderate-cost plan and $1, on a. Here is the definitive answer in writing. Below you will find the ideal household budget. But here is what you need to know. When people legitimately take my advice into consideration and do the work it takes to grocery shop and meal plan the frugal way, $ per person is not only. Quick Tips For Grocery Budgeting · 1. Determine Your Budget. The first step is to get a better understanding of how much you should spend on groceries per week. Doable if you're attentive. I spend $–$ per month on food for myself and my husband, not counting the occasional restaurant meal, and not. According to the U.S. Bureau of Labor Statistics, Americans devote between 11% and 15% of their budget to food each year. If you're sitting at the 15% mark. In January , the average monthly food costs for home-prepared meals for a family of six (with the same ages as Debbie's family members) ranged from. Calculate Overall Costs · Adjusted food costs for each person in household. · 1-person — add 20 percent · 2-person —add 10 percent · 3-person — add 5 percent · Americans spend an average of $5, a year, or roughly $ a month, on groceries, according to consumer expenditure data released by the U.S. Bureau of Labor. According to the USDA guidelines, you might spend $ a month on a thrifty plan, $1, on a low-cost plan, $1, on a moderate-cost plan and $1, on a. Here is the definitive answer in writing. Below you will find the ideal household budget. But here is what you need to know. When people legitimately take my advice into consideration and do the work it takes to grocery shop and meal plan the frugal way, $ per person is not only. Quick Tips For Grocery Budgeting · 1. Determine Your Budget. The first step is to get a better understanding of how much you should spend on groceries per week. Doable if you're attentive. I spend $–$ per month on food for myself and my husband, not counting the occasional restaurant meal, and not.

Here is the definitive answer in writing. Below you will find the ideal household budget. But here is what you need to know. After working with a lot of couples and individuals on their budgets and after tweaking mine over the years, I have an unofficial formula for grocery spending. How Much Money to Spend on Grocery Shopping You're probably not surprised to know that the average family of 4 spends between $ and $ per month on food. I'd say a reasonable grocery budget for an average, single adult male should be $$ per month. For a high calorie diet you're looking at. You can also look at your recommended grocery spending based on a percentage of your income. Try and aim to spend no more than 15% of your take home pay on food. You want to create a budget with your income minus all of your fixed expenses (mortage/rent, utilities, insurance, etc) and categorize the rest- including food. Food is an essential expense that no one wants to skimp on. And no one should ever have to in an ideal world. I'm a big foodie and I love to eat, but I'm the. Thrifty plan. For a thrifty budget for a family of four, you would spend $ a week or $ a month. The Thrifty Food Plan, incidentally, is used to. The guidelines suggest you spend 5 – 10% of your income in this category. However, if you happen to have young children in daycare, have high education costs. Have a food budget. A rough rule of thumb is to allow about $ a week per person in your household, but the overall amount shouldn't be more than one-. Most experts recommend budgeting around 10% of your income to food costs. How much should a family of four spend on groceries? Depending on where you live, the. The USDA kindly provides “Official USDA Food Plans” to help families decide how much money they should be spending on food. They provide four food plans. A four-person household spends an average of $ per week on groceries. 2. Study Overview. While U.S. inflation slowed in , grocery store cash registers. Generally, the average single adult spends anywhere from $59 to $91 every week on groceries. If you're looking to cut down on your expenses, you can take a look. What does the average U.S. household spend on groceries per month? According to data from the Bureau of Labor Statistics, the average spending on food at. Try to keep your grocery budget to around % of your income. If you spend less, great job! If you spend more, this is for you! What is NOT Included in Your Grocery Budget · When To Bump Your Grocery Budget · How much are you spending? ; 1. Plan Your Budget Monthly · 2. Plan Your Shopping. If the average meal at home costs $3-$4, bulk meal prep can shave an additional percent off of your per-meal costs. When you add in all the time you save. Generally, the average single adult spends anywhere from $59 to $91 every week on groceries. If you're looking to cut down on your expenses, you can take a look. What does the average U.S. household spend on groceries per month? According to data from the Bureau of Labor Statistics, the average spending on food at.